Packaging Academy, Pet Food

Pet Food Premiumization: Is Trading Up Still Growing in 2026—or Is Value Winning Back Share?

Pet brands feel squeezed. Premium stories still sell, but value pressure keeps rising. Many teams guess which trend “wins” and then miss what customers actually did.

Premiumization can keep growing while value wins back share. The split is usually category, tier, and channel. The only safe answer comes from unit share, dollar share, and mix shift.

If you want packaging decisions that match the real shelf battle (not the headline story),

build your spec around the tier, the route, and the return risk.

This article gives a research-first way to tell where trading up is still real, where value is taking share, and how to prove it without cherry-picking charts.

People argue because they measure different things. One chart can “prove” premium is winning, while another “proves” value is winning. Both can be true.

Premiumization is not a vibe. It is a set of measurable shifts in price tier, units, and promotional reliance. If you do not separate these, you will misread inflation as “trading up.”

Use a three-metric rule before you conclude anything

| Metric | What it can prove | Common misread |

|---|---|---|

| Dollar share ($) | Where revenue is concentrated | Higher prices look like “premium growth” |

| Unit/volume share | What people actually bought more often | Smaller packs can hide trade-down |

| Tier mix + promo depth | How the middle gets squeezed | Promos can “buy” volume temporarily |

Evidence (Source + Year): American Pet Products Association (APPA) industry spending/expenditure reporting (2024–2025); NielsenIQ/Circana-style retail measurement frameworks widely used for unit vs dollar interpretation (2024–2025).

What changed in 2024–2026 that could push value back?

When budgets tighten, pet owners do not always quit. They adjust. They change channels. They wait for deals. They switch part of the basket to value tiers.

Value “winning back share” usually shows up first in everyday staples and in channels where promotions and private label are strongest. It is less about love for cheap products and more about lowering the cost of the routine.

Track the pressure points that create trade-down behavior

| Pressure point | What shoppers do | What changes in data |

|---|---|---|

| High price sensitivity | Trade down within the same format | Unit share shifts to value tiers |

| Retailer competition | Shift to mass/club/value channels | Channel mix moves toward price leaders |

| Promotion intensity rises | Buy only on deal or in bulk | Promo share grows; base price elasticity increases |

Evidence (Source + Year): APPA pet industry expenditure summaries showing category scale and spending context (2024–2025); reporting on private-label growth and consumer value seeking in U.S. grocery/CPG (e.g., industry coverage citing record private-label share) (2025).

Premium holds when the benefit is easy to feel. If shoppers can see, smell, or believe the difference quickly, they protect that spend longer.

This is why premium growth often concentrates in fresh/frozen, functional claims, and higher-impact treats. These subcategories behave like “experience upgrades,” not just nutrition.

Premium growth tends to cluster where the claim is not abstract

| Segment | Why premium can hold | What to watch in 2026 |

|---|---|---|

| Fresh / frozen | Strong perceived difference | Repeat rate and distribution expansion |

| Functional add-ons | Goal-based purchase logic | Claim credibility and churn to cheaper imitators |

| Premium treats | Small-ticket indulgence | Trade-down inside treats, not out of treats |

Evidence (Source + Year): Fresh pet food growth coverage in business media and industry reporting (2024–2025); APPA category spending context for pet food/treats (2024–2025).

Value does not win by saying “cheap.” It wins by being “good enough” and easy to buy where people already shop for savings.

If value is really winning back share in 2026, you usually see private label improve, promotions increase, and volume migrate to mass/club/value channels. These are structural moves, not a one-week dip.

| Value lever | Why it works | Leading indicator |

|---|---|---|

| Private label | Retailer shelf control + tiered pricing | Unit share rise in value tiers |

| Promo depth | Turns premium into “affordable premium” temporarily | Promo share up; base demand weakens |

| Channel shift | Price leaders capture routine baskets | More volume in club/mass; less specialty share |

Evidence (Source + Year): Public reporting on record private-label share and faster growth vs national brands (2025); retail and packaged food industry coverage describing share loss to private label and portfolio shifts (2024–2025).

If your packaging has to survive bigger channel moves (club cases, longer dwell time, higher handling),

we match barrier and seal integrity to the value tier’s route stress

so the pack still performs when margins are tight.

Why “two-basket” households explain the 2026 paradox?

Many households are not consistent. They trade down and trade up at the same time. That is why premium and value can both grow.

They protect spend where the difference feels real, and they cut spend where products feel interchangeable. This often becomes “value for the staple” and “premium for the treat or function.”

Split the basket to predict what changes first

| Basket role | Typical behavior | Most likely shift in 2026 |

|---|---|---|

| Daily staple | Repeat and cost control | Deal shopping, pack-price architecture, private label trial |

| Visible upgrade | Perceived benefit and reassurance | Stickiness, but with smaller packs or fewer SKUs |

Evidence (Source + Year): Consumer value-seeking behavior and private-label adoption discussed across major retail/CPG reporting (2024–2025); APPA spending context supporting continued category engagement despite trade-down behavior (2024–2025).

Decision map for 2026: which story is true for your category?

The right answer depends on your format and your channel. A premium dry kibble SKU does not behave like premium treats. A club pack does not behave like specialty retail.

Use leading indicators that match the category’s role. Do not rely on revenue share alone. If you can only track one thing this quarter, track unit share by tier inside your channel mix.

Pick one leading indicator per category role

| Category / format | Best leading indicator | What to watch next |

|---|---|---|

| Staple dry food | Unit share by tier + promo dependency | Private label penetration and pack-size shifts |

| Treats | Repeat rate and review sentiment | Trade-down within treats (not out of treats) |

| Fresh / functional | Distribution growth + retention | Churn after trial; price elasticity under promotions |

Evidence (Source + Year): Retail measurement best practices using tier mix, unit share, and promo depth to separate price from volume (NielsenIQ/Circana frameworks) (2024–2025); industry reporting on subcategory growth engines such as fresh pet food (2024–2025).

Most teams lose time because they argue from opinions. You can end the debate with a small set of tracked signals that are hard to fake.

Use the same dashboard each quarter. If premium unit share rises while value unit share rises too, then the middle is being squeezed. That is a strategy signal, not a confusion problem.

A lightweight proof checklist you can run every quarter

| Question | Metric | Pass/fail interpretation |

|---|---|---|

| Is premium growth real? | Premium tier unit share | Up = real trading up; flat with $ up = price effect |

| Is value winning back? | Value/private label unit share | Up = structural value gain, not just promo noise |

| Is demand being “bought”? | Promo share + depth | Up fast = repeat risk when promos stop |

| Is the channel mix changing? | Units by channel | Shift to club/mass = value pressure increases |

Evidence (Source + Year): APPA spending context (2024–2025); public retail reporting on private-label growth and value-oriented channel competition (2024–2025).

Conclusion

In 2026, premium and value can both win. The real job is to prove where and why. If you want packaging that matches your tier and route, talk with us.

Get a Pet Food Packaging Spec That Fits Your Tier

About Us

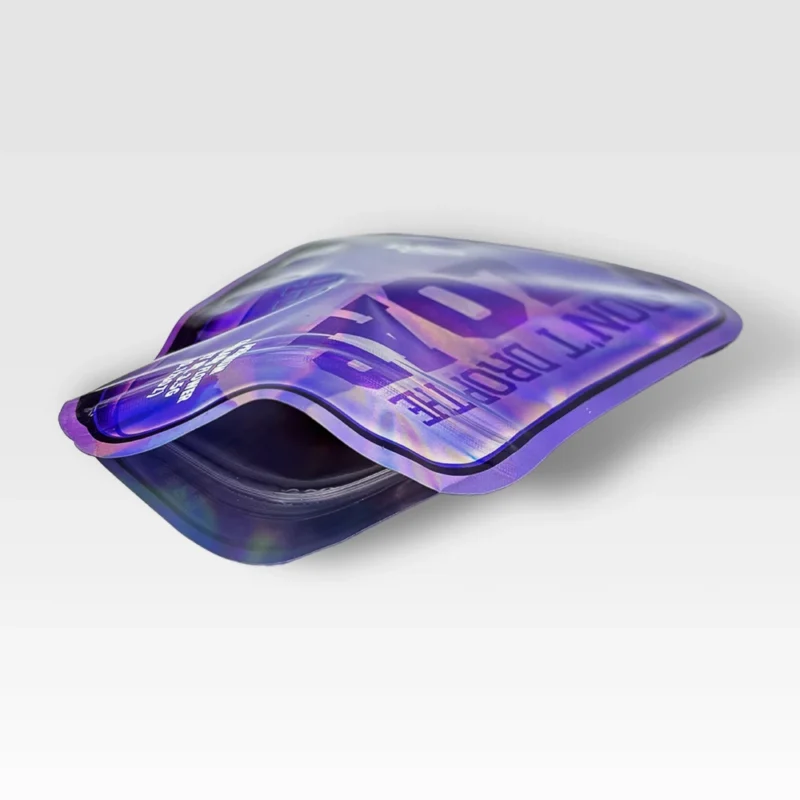

Brand: Jinyi

Slogan: From Film to Finished—Done Right.

Website: https://jinyipackage.com/

Our Mission:

JINYI is a source manufacturer specializing in custom flexible packaging solutions. We focus on reliable, usable, and production-ready packaging systems that help brands reduce communication costs, achieve predictable quality, and keep delivery timelines clear.

About JINYI:

JINYI is a source manufacturer specializing in custom flexible packaging solutions, with over 15 years of production experience serving food, snack, pet food, and daily consumer brands.

We operate a standardized manufacturing facility equipped with multiple gravure printing lines as well as advanced HP digital printing systems, allowing us to support both stable large-volume orders and flexible short runs with consistent quality.

From material selection to finished pouches, we focus on process control, repeatability, and real-world performance. Our goal is to help brands reduce communication costs, achieve predictable quality, and ensure packaging performs reliably on shelf, in transit, and at end use.

FAQ

- Can premiumization grow while value gains share?

Yes. It often means the mid-tier is being squeezed while both ends gain. - What is the fastest way to detect trade-down?

Track unit share by price tier, not just dollar share. - Why does private label matter so much in 2026?

Private label gains usually signal structural value competition, supported by shelf control and pricing tiers. - Which pet food segments keep premium demand longer?

Segments with visible benefits, such as fresh/frozen, functional add-ons, and premium treats, often hold better. - How does packaging strategy change between value and premium tiers?

Value tiers often need tighter cost control and route-stress reliability, while premium tiers often prioritize barrier and sensory consistency.